Onboard Deals (Funds & Companies) to Raise Capital

361Firm helps companies and funds access capital via (1) community events and/or (2) systematic investment banking for formal marketing, inclusion at Allocator Sessions and possibly 361Core (an invite-only club that votes on deals to share, vet and co-invest).

You Can Raise Your Profile at Events such global conferences, weekly Briefings, Lunches and Deep Dives, as a sponsor (361firm.com/sponsors).

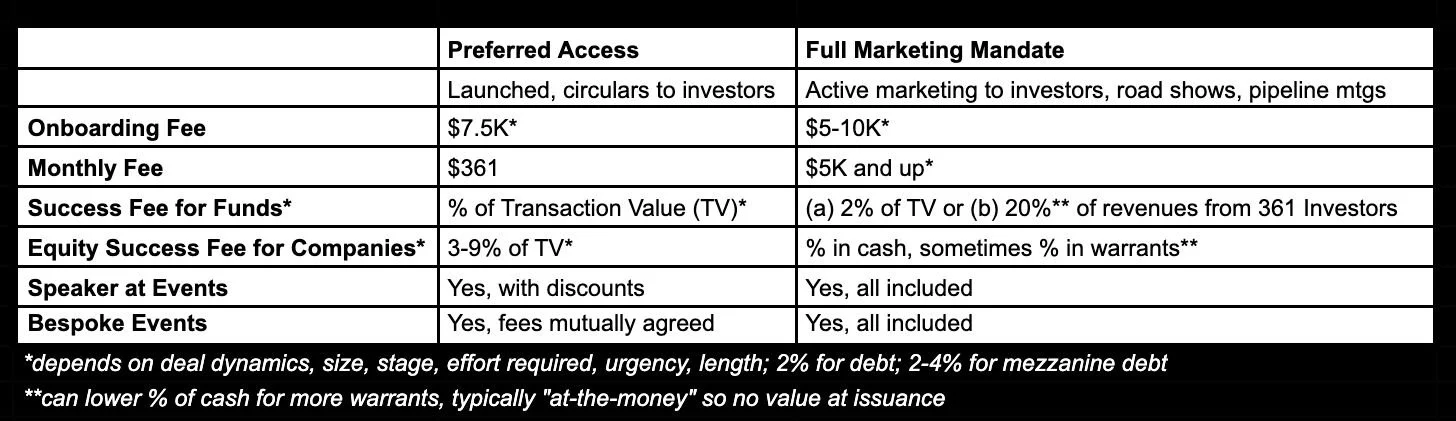

You Can Become a 361 I-Banking Client - 2 Options: (1) Access for inclusion in our Deal Pipeline and events with discounts or (2) a Full Mandate with an active marketing process, speaker at events (some bespoke). Fees differ per the table below, and process below.

To become an investment banking client, you need to take the following steps:

1) Onboard your Deal via the form below. To increase your chances, note acceptance of the template agreement except for any proposed changes

2) Engagement Letter. See templates for a Company EL, anda Fund EL.

3A) Due Diligence. Submit info for our Due Dil. Checklist (see Template for a Fund or Company).

3B) Broker-Dealer Approvals. Our B-D approves Mandate, then reviews Marketing Materials, notes any changes needed.

4) Launch Marketing. Services depend on the type of mandate (Access or Full), the level of effort required and other factors.